But our housing landscape is evolving. Firstly, we have fewer and fewer large tracts of undeveloped land left to build new towns and estates. Tengah will be the last new town for quite some time, at least until Paya Lebar Air Base moves out to Changi and the site is cleared and redeveloped. Increasingly, we will have to build new HDB flats within or near to existing estates. These will often be more centrally located. For example, at Mount Pleasant, where the Police Academy used to be, we are planning to build 5,000 new homes there. New projects like these – nestled in older, more developed areas with a lot more amenities – will be more popular, and will naturally cost more. Secondly, even what we call “Non-Mature Estates” today have become much more developed. We imagine non-mature estates as being very barebones. Blocks of flats surrounded by empty barren ground. Our mental image is this photo, and once upon a time it looked like this – this was Toa Payoh in the 1960s. Toa Payoh does not look like this today. But look around you now. Towns like Jurong East, Woodlands, or Punggol, that is not barebones. These towns have matured, and now have excellent connectivity and a full suite of amenities, so the distinction between Mature and Non-Mature Estates is blurring. This is reflected in BTO applications. Some choicer projects in Non-Mature Estates are even more popular than projects in Mature Estates. It shows that buyers are discerning – you know when you see a good deal, and what matters to you are the specific attributes of the project, rather than whether we call it Mature or Non-Mature.

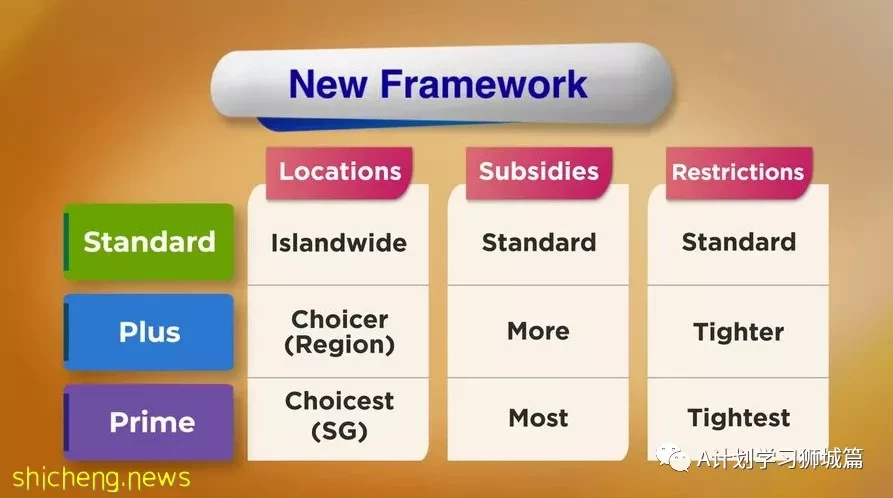

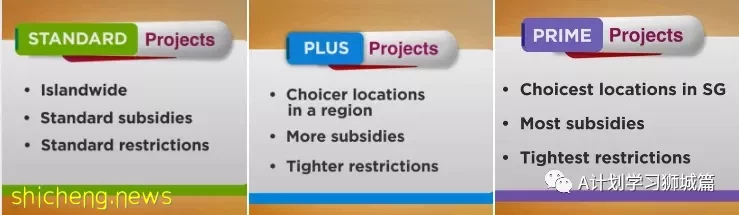

In future, many more BTO developments will be in estates or locations that are effectively “mature”. That means that the framework of Mature and Non-Mature Estates will no longer work and we need a new framework. This framework has to achieve three important objectives: One, it has to keep home ownership affordable to all income groups. Two, it has to maintain a good social mix in every town and every region. And three, it has to keep the system fair for everyone. And here is how we will do it.

For a start, we will keep HDB flat prices affordable. We will gradually provide more housing grants, especially grants that are means-tested, like the Enhanced Housing Grant. This way, lower- and middle-income households will get the most support to own their homes. There will always be an HDB flat to meet every budget. And we can maintain a good social mix in every town and region.

This will work for most HDB projects, but it will still leave one particular problem and that is, with projects in choicer locations within a region. For example, projects near an MRT station or near the town centre. Such flats see the highest demand during BTO exercises. People know that HDB is offering a good deal, because these flats will fetch much higher resale prices afterwards. This turns the BTO exercise into a lottery. Those who are lucky enough to ballot such a flat stand to reap a windfall upon resale. This will not be fair to the many more who miss out.

Take for example one recent BTO project: Central Weave at Ang Mo Kio. This is Ang Mo Kio; let me zoom in, Central Weave is right at the town centre. Let me zoom in a little bit more. It is next to the MRT and bus interchange. The market is there, the hawker centre is there, Ang Mo Kio Hub is nearby. So location, location, location. This is an excellent location; this is a highly desirable project. HDB’s selling price had to reflect these attributes. So, the prices for the biggest flats at Central Weave – the 5-Room and 3-Gen flats – ranged from $713,000 to $877,000, before grants. Even then, these flats were heavily discounted off their true market value. Some people complained that these prices were exorbitant and unaffordable. Yet these units were heavily oversubscribed. More than 6,500 households applied for just 372 such flats – 17 applicants for every flat! Clearly, these applicants must have found the Central Weave project affordable, and thought that the prices offered them good value. And no doubt many hoped their flats would fetch strong resale prices later on.

So think about it. If you were HDB CEO sitting down, confronted with this problem, what will you do? You have a dilemma, a dilemma with projects at choicer locations like Central Weave: should we price them higher, or lower? If we price them higher, we will shrink the windfall gains, reduce the lottery effect. This will moderate demand and that is good. But there will be sticker shock – these flats will become expensive and unaffordable to most families. And we will not get a good social mix. Some people will still afford them, but mainly those near the income ceiling, or those whose parents can help them pay for the flat. The result: the precinct will become a higher-income enclave, and that is not what we want. But if HDB prices such prices lower, more households can afford them; we achieve a better social mix, that is good, but we exacerbate the lottery effect, because the potential windfall will be even richer. Even more families will try for these flats. For every one happy successful buyer, there will be 20 or more unsuccessful buyers, and they will understandably and justifiably frustrated and very unhappy. And this is not fair. So under the present framework, whether we price such flats higher or lower, we cannot fully achieve all three objectives: affordability, a good social mix, and a fair outcome.

So what do we do? Central Weave is already sold, but we can expect more such situations as we build more flats in existing towns.

How do we solve this problem?

New “Plus” model

Our solution is to introduce a new “Plus” model for selling HDB flats at choicer locations, with stricter sale conditions so that we can moderate the prices. Let me explain carefully what I mean.

Today, HDB launches BTO projects all over Singapore. We are all familiar with them. Everybody knows the BTO rules. For example, a 5-year Minimum Occupation Period, or MOP, after which the owner can resell the flat. There is no income ceiling for resale buyers. These are the standard rules and apply to what I will call “Standard” projects. In future, most HDB projects will still be Standard projects.

But within each region, some HDB projects will be in choicer locations. Take for example, Bayshore, in Bedok. This is Bedok town. Bayshore is there, let me zoom in. And you can see, Bayshore is a very good location for homes, because you have got two MRT stations, Bedok South and Bayshore MRT stations. Shopping malls will be built in this corner, Siglap CC is there. East Coast Park is across the road, and then you have the waterfront, 有山有水.

We will have both private and public housing in Bayshore. The HDB projects will likely be Plus projects and will be sold under different rules. HDB will give more subsidies for these Plus flats, over and above the subsidies for Standard BTO flats. This will moderate the prices of Plus flats and put them within reach of more households. But to make the scheme fair, HDB will also impose more restrictive sale conditions. For example: A longer MOP of 10 years, to favour buyers who are planning to stay there for the longer term, and discourage those who may be thinking of flipping the property and moving out as soon as they can. Tighter restrictions when the home-owner resells the Plus flat later on, such as a subsidy recovery applied on the resale price, certain percentage when you sell the flat, you pay back a certain percentage back to HDB to take back the extra discounts you enjoyed upfront since you are moving out. This is to be fair to other buyers who did not get these Plus flats. Also there will be an income ceiling on resale buyers, just like how we have an income ceiling on first-time buyers. This will moderate resale prices and help to maintain a better social mix, even in the resale market in the longer term.

As we build more projects in mature areas, this Plus model will help us to meet our three objectives: affordability, good social mix, and fairness. I keep on showing you this slide because this is crucial. These are the three fundamental objectives and we must bear that in mind, when we think about what is HDB doing, why is HDB doing this, how does doing this help us to achieve these objectives? It will help Singaporeans find a house that suits your needs, even in good locations. Not just for you, but for your children too.

Standard, Plus and Prime

Actually, the Plus model is not entirely new; we already have something similar, called the Prime Location Public Housing Model. Let us call them Prime projects for short. One example is Bukit Merah Ridge. Like other Prime projects, it is very close to the city centre. Naturally, these flats are very desirable, and will be more expensive. But we have been able to keep their selling prices reasonable by imposing tight restrictions and a subsidy recovery to moderate the windfall gains. The Prime model has shown good outcomes so far. In Bukit Merah Ridge. The selling price for a four-room flat ranged from $540,000 to $737,000, before grants. Each flat attracted 5.4 applicants – far fewer than Central Weave, even if you compare to the four-room flats in Central Weave. And we hope that Plus projects will achieve similarly good outcomes. So, let me go back to Central Weave because you are probably thinking and asking: had we sold Central Weave as a Plus project, with the tighter restrictions and additional subsidies, would HDB have priced it lower than it actually did? The answer is yes, it would, because that is the whole point of Plus projects: to enable HDB to moderate the prices of flats in choicer locations, and still be fair to all flat buyers.