引言

新加坡政府在确立新加坡为国际金融中心方面采取了多种策略,以吸引企业和高净值个人士前往新加坡,并发布多种金融和税收激励措施来加强其国际金融中心的角色。

The Singapore government employs many tactics to entice corporations and high net worth individuals to move to Singapore to enhance its role as international financial hub, including both financial and tax incentives.

初创企业税收计划 Startup Tax Schemes

为鼓励创业精神并促进本地企业的发展,新加坡政府为符合条件的初创公司提供多项税收豁免。

To encourage entrepreneurship and grow the country’s local enterprises, the Singapore government offers many tax exemptions to qualifying companies in the startup phase.

所有在新加坡运营的公司,都有资格获得部分税务减免 (PTE),但是不包括已经得到新成立公司税务减免计划的公司。

All companies operating in Singapore are eligible for Partial Tax Exemption (PTE), except those that have already been granted the Newly Incorporated Companies (NIC) Tax Relief Scheme.

部分税务减免计划即:首一万新元的应税收入享受75%的税收减免,之后的一万至二十万新元的应税收入享受50%的税收减免。

Partial Tax Relief Scheme i.e. 75% tax relief on the first S$10,000 of taxable income and 50% tax relief on the subsequent S$10,000 to S$200,000 of taxable income.

新成立公司税务减免计划即:对首10万新元的应税企业净利润给予75%的豁免,以及接下来10万新元的应税企业净利润给予50%的豁免。这一宽松的豁免政策适用于前三个连续的评估年度(YA)。

The tax relief scheme i.e. 75% exemption for the first S$100,000 of net profits of a taxable business and 50% exemption for the next S$100,000 of net profits of a taxable business. This generous exemption applies for the first three consecutive Years of Assessment (YA).

为了符合初创企业税收豁免计划的条件,公司主要活动不得从事投资业务,或从事出售、开发或两者兼有的房地产开发业务。

To qualify for the startup tax exemption scheme companies must not be a company whose principal activity is that of investment holding or a company that undertakes property development for sale, development, or both.

此外,初创企业必须在新加坡注册成立,并成为该评估年度的新加坡税务居民,并且其全部股本必须由不超过20名股东直接持有,且所有股东都是个人;或者至少有1名持有公司发行普通股份中至少10%的个人股东。

Additionally, the startup must be incorporated in Singapore, be a tax resident of Singapore for that YA, and have its totally share capital beneficially held directly by no more than 20 shareholders throughout the basis period for that YA where all the shareholders are individuals; or at least 1 shareholder is an individual holding at least 10% of the issued ordinary shares of the company.

国际总部税收计划 International Headquarter Tax Schemes

除了初创企业外,新加坡经济发展局(EDB)通过国际总部(IHQ)激励计划鼓励大型企业来到新加坡设立总部。

In addition to startups, the Economic Development Board (EDB) encourages larger corporations to create their headquarters in Singapore through the International Headquarters (IHQ) incentive.

获得先锋证书激励(PCI)或发展扩张激励(DEI)批准的公司可享受从符合条件的活动所产生的收入的5%或10%的税收免税,在有限的五年免税期内,根据公司未来扩张计划的承诺,此税收减免期限可进一步延长。

An approved company under PCI or DEI is eligible for tax exemption of 5% or 10% on income generated from qualifying activities with a limited period of five years that can be further extended based on company commitment to future expansion plans.

家族办公室 Family Offices

新加坡金融管理局(MAS)为家族办公室提供税收激励,吸引高净值个人将财富转移到新加坡,以提振资产和财富管理行业。

The Monetary Authority of Singapore (MAS) offers tax incentives for family offices, attracting high net worth individuals to move the wealth to Singapore to grow the assets and wealth management industry.

家族办公室是一个进行私人投资和财富管理实体架构,负责管理和处理家族的财务和非财务事务,其目标是财富保全、家族财富增长,并进行传承规划。

A family office is a structure runs private investment and wealth management entity that oversees the administration and management of a family’s financial and nonfinancial matters. The goal of this family office is to preserve, grow the family wealth and legacy planning.

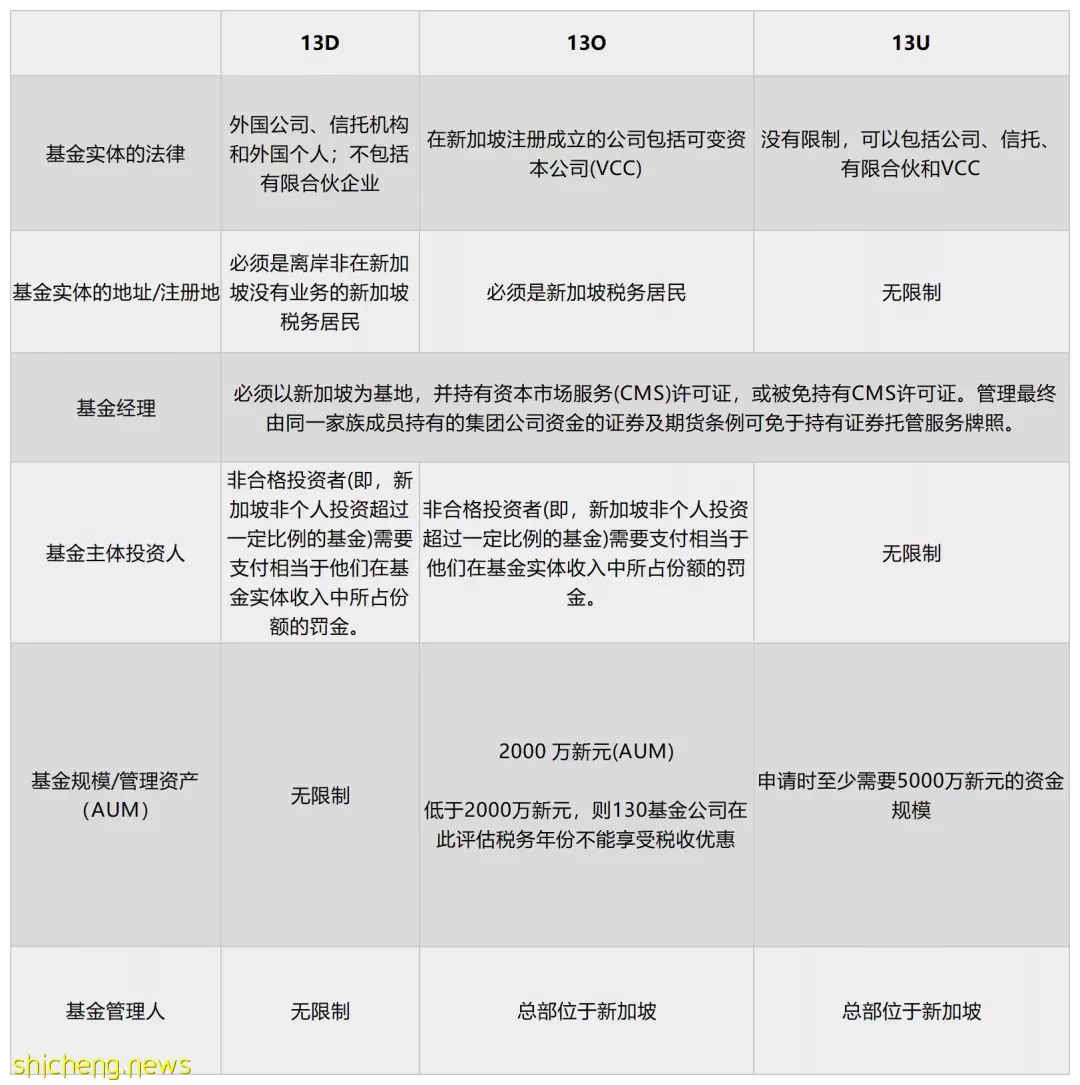

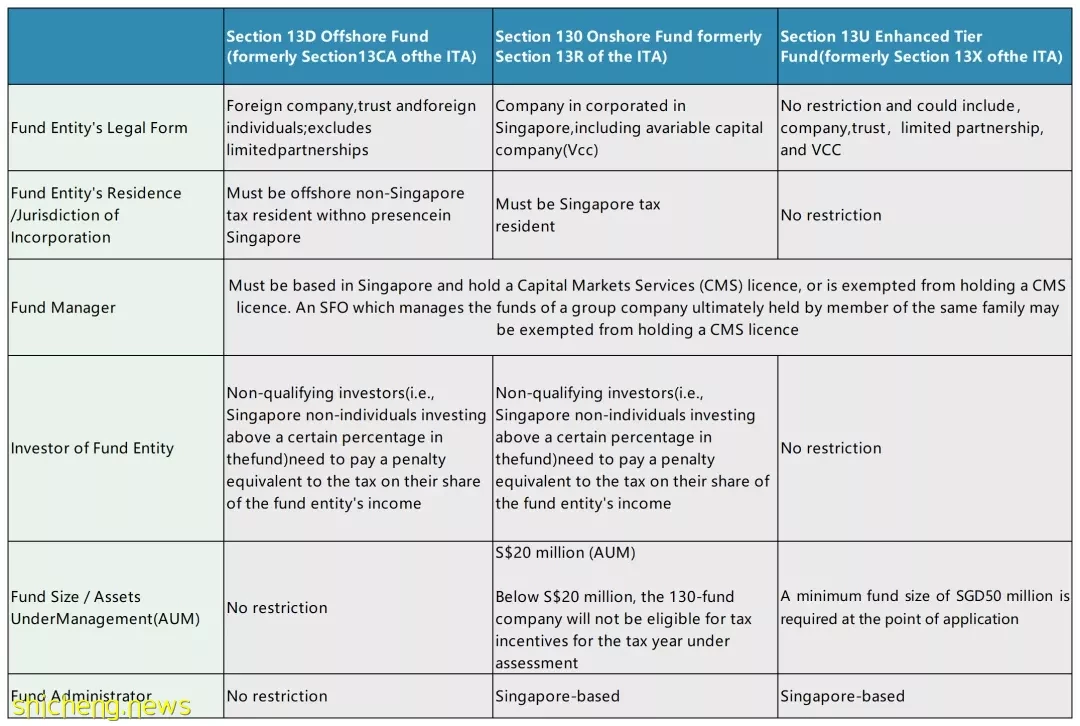

家族办公室有多种的税收计划,包括离岸基金税收豁免计划(13D)、在岸基金税收豁免计划(13O)和增强层级基金税收豁免计划(13U)。具体请看下图:

There are a variety of different tax schemes for family offices, including Offshore Fund Tax Exemption Scheme, Onshore Fund Tax Exemption Scheme, and Enhanced Tier Fund Tax Exemption Scheme.

中英文版本-家办税收豁免计划

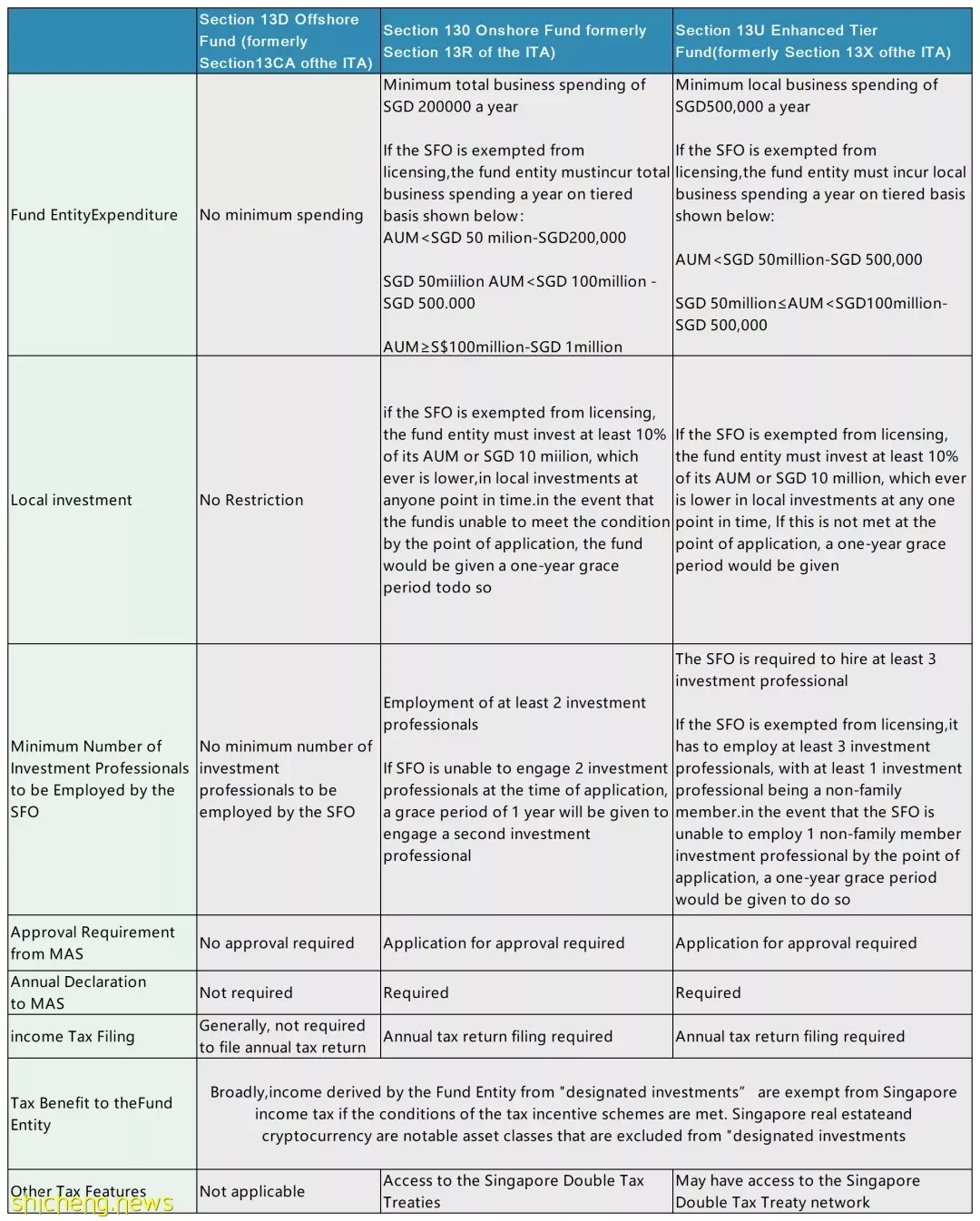

除了上述的税收计划外,合资格的家族办公室还可能有资格申请金融部门激励基金管理(FSI-FM),该计划对家族办公室取得的符合条件的收入征收10%的税率。这一税率比普通公司所得税率低7%。

In addition to the tax schemes above, the qualified family office may be eligible for the Financial Sector Incentive Fund Management (FSI-FM) which applies a 10% tax rate to qualifying income derived by the family office. This tax rate is 7% lower than the normal corporate income tax rate.

必须满足以下条件才能符合资格:必须持有货币管理服务许可证(CMS许可证),除非得到MAS的豁免规定;必须雇佣至少三名投资专业人员;并且必须拥有至少2.5亿新元的最低资产管理规模(AUM)。

The following conditions must be met to qualify for the 10% tax rate: must hold a CMS license unless exempt by the MAS, must employ at least three investment professionals, and must have a minimum AUM of S$250,000,000.