李顯龍總理

2023國慶群眾大會演講

Singapore

8月20日晚,李顯龍總理在宏茂橋的工藝教育學院總部,發表國慶群眾大會演講。

英文演講全文

「A BETTER HOME, A BRIGHTER FUTURE」

SECTION 1: INTRODUCTION

My fellow Singaporeans, good evening.

Return to Normalcy

We are all relieved that COVID is behind us. Life as we knew it has resumed.

COVID-19 was the most challenging ordeal for our nation since Independence. We can all be proud of how we pulled through together. Unlike many other countries, Singapore has emerged from the pandemic stronger, more resilient, and more united. This is a tribute to the indomitable spirit of our nation.

Global situation and economic outlook

Having come through COVID, we are once again being tested. The international environment is fraught with geopolitical tension and economic uncertainty.

We feel acutely the pressures mounting all around us. The rivalry between the US and China affects every country and region in the world. Their mutual wariness and distrust has deepened. The rest of the world has to tread a careful path, to avoid being caught in the cross-fire. The war in Europe rages on. Russia’s invasion of Ukraine is a continuing human tragedy, and an assault on international norms and values. It is a cautionary warning to the rest of the world never to take peace for granted, and a reminder to us of the vital importance of a strong SAF. Meanwhile, the global economic order is fraying. Globalisation is weakening. Supply chains are splitting up. Countries are layering on multiple protectionist measures. This hurts all countries, but especially small, open trading nations like ourselves. With global warming, the world is also experiencing more extreme weather. From Chinato Japan, to Europe and the US, no region is spared from floods and droughts, heatwaves and wildfires. This will affect food production and prices worldwide. We have not fully felt it in Singapore yet, but it is coming.

Economically, Singapore is keeping up. We expect positive economic growth this year. Hopefully, we will avoid a recession. Inflation is at last coming down, but it will probably stay higher than what we were used to. The cost of living is still on everyone’s minds. In my Chinese speech earlier, I explained how the Government will continue to support you. We will weather this storm together.

Forward Singapore

Our nation must navigate carefully in this increasingly troubled landscape. There is no ready playbook, there is no model answer. I am glad that DPM Lawrence Wong and the 4G team have taken it upon themselves to chart out where Singapore will go from here. They launched Forward Singapore in June last year, to refresh our social compact. They have held dialogues with thousands of Singaporeans who shared their ideas to tackle various issues. For example: how to equip our people with the skills to succeed; how to improve care for the vulnerable; and how to strengthen our solidarity as one people. The Forward Singapore report will be published later this year. It will be a compass to help Singapore navigate through the stormy seas.

Despite the dark clouds, the world still offers many opportunities for those who dare to seize them. In my Malay speech just now, I spoke about promising new sectors such as the digital economy. I also shared that the Government will give more support to workers – to help you adapt and upskill, to stay ahead of the game. Our Forward SG plans include financial support for workers who lose your jobs, while you upgrade your skills. It will be a temporary safety net to help you meet immediate needs, to free you to upskill and train, as you prepare yourself for a good long-term job. So long as you are willing to make the effort, the Government will go the extra mile to help you.

SECTION 2: RETIREMENT

Financial concerns are top-of-mind not just for younger workers, but also the older ones. These concerns become more urgent as we approach retirement.

Especially for those in their 50s and early 60s. Let us call them the 「Young Seniors」. "Young」, because you are younger than the Pioneer Generation and the Merdeka Generation; 「Seniors」, because you will soon retire, or maybe you have recently retired.

Young Seniors are in a unique position today. Compared to the Pioneer and Merdeka Generations, you have benefited more from Singapore’s growth, and generally done better in life. But compared to workers younger than you, in their 30s and 40s today, you have generally earned less over your lifetimes. You have also had less time to benefit from improvements to the CPF system, and so have built up less retirement savings. Young Seniors are also in a particularly sandwiched phase of your lives. You have to shoulder the responsibility of caring for both the young and old in your families. Your kids may be young adults, but often are not yet fully independent and still live in the same household. Many of you Young Seniors also have elderly parents at home, who may be beset with the infirmities of old age. You have to shuttle them to medical appointments and hospital visits, plus attend to their everyday needs. All this, while watching your own health, because you are not so youthful yourselves. Responsibilities on all these fronts multiply your burdens. So, as Young Seniors, you are understandably anxious about your retirement needs. Beyond the daily cost of living pressures, you know that retirement is creeping up on you. You wonder: Will I have enough to get by? Can I cope? But do not worry – the Government will help you. You will not be left behind.

Majulah Package

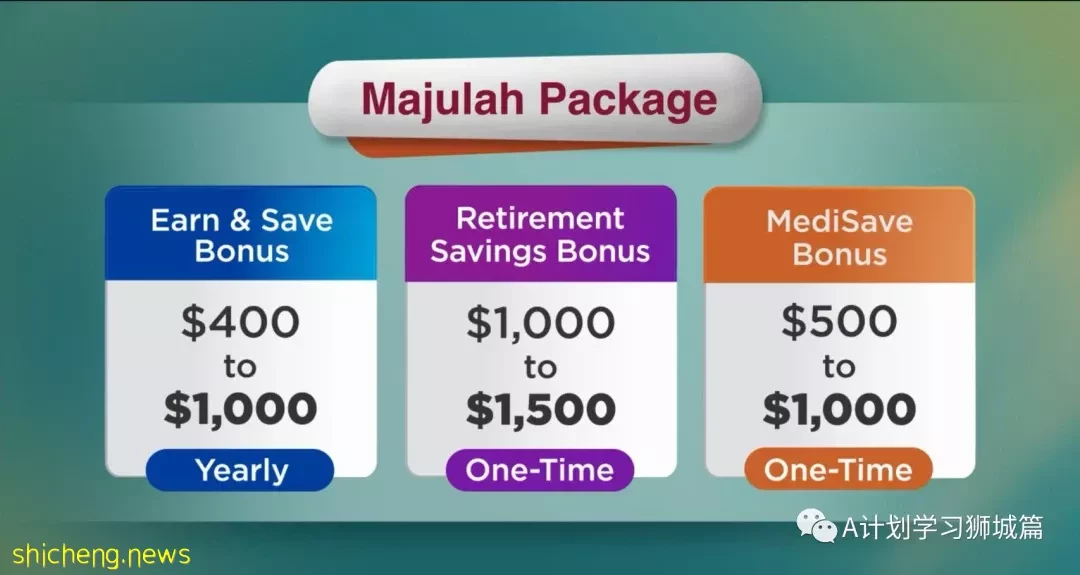

We will introduce a package to help Young Seniors meet your retirement needs – let us name it the Majulah Package. This will be for Singaporeans who are 50 and above this year – born in 1973 or earlier. It will benefit those with lower incomes and less wealth. The support will be tiered, depending on your income and your CPF savings. The Majulah Package will comprise three components.

First, an 「Earn and Save」 Bonus, to help you build up your CPF savings while you work. Most Young Seniors are still working, and have some years to go before retirement. We encourage you to continue working as long as you can. Lower- and middle-income workers will get a CPF bonus of up to $1,000 a year, depending on your income. The Government will credit this into your CPF account, on top of the usual employer and employee contributions. You will receive this Earn and Save bonus yearly, as long as you are working, whether full-time or part-time. Take for example a lower-income 55 year-old who plans to retire at 65. Over 10 years, her Earn and Save bonus adds up to $12,000 in extra CPF savings if you include the CPF interest, which is not bad.

Second, a Retirement Savings Bonus (RSB). If your CPF balances have not reached the CPF Basic Retirement Sum, you will receive a one-time CPF bonus of up to $1,500. Those who are not working will get this bonus too. This includes homemakers, who have given up their careers and laboured to raise their families, and thus have very low CPF balances.

Third, a MediSave Bonus. Most Young Seniors have enough MediSave balances. Nevertheless, many still worry about healthcare costs, because you will soon be Not-So-Young Seniors. So the Majulah Package will include a modest one-time MediSave Bonus of up to $1,000. It will give you some extra buffer, to help pay your medical expenses and insurance premiums.