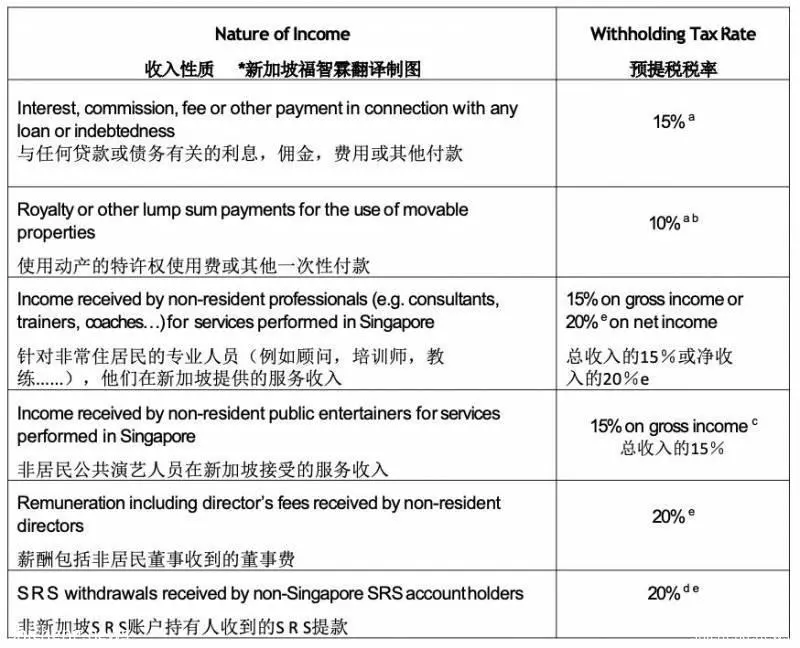

注意! 在向非居民提供某些類型的付款(例如利息,特許權使用費,服務等)時,個人必須預扣稅款。預扣稅率取決於付款的性質。

A person must withhold tax when certain types of payments (e.g. interest, royalty, services etc.) are made to non-resident persons. The rate of withholding tax depends on the nature of payment.

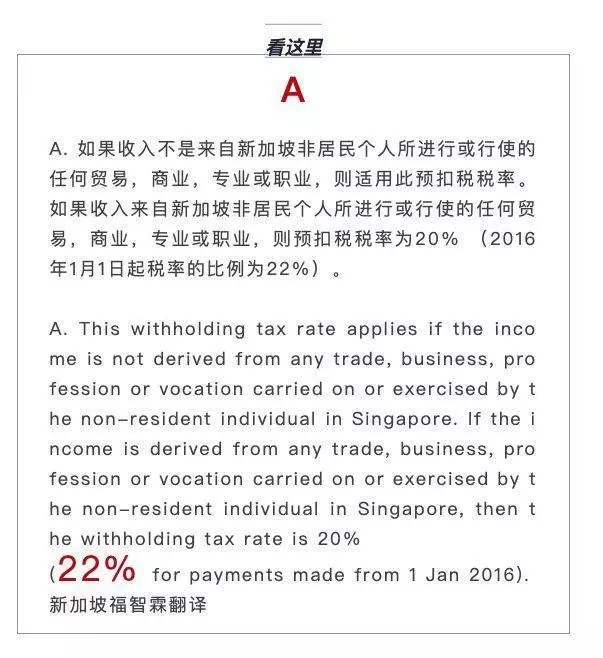

針對以上圖表中的標示字母,請看下面的講解。

什麼是SRS帳戶

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

新加坡補充退休計劃(SRS)是一項自願計劃,旨在鼓勵個人為退休儲蓄, 在他們的公積金儲蓄基礎上更多保障。 SRS上的儲蓄有資格獲得減稅。投資回報在提款前是免稅的,在退休時只有50%的SRS提款需納稅。

發帖時間: 新加坡福智霖投資資訊